Banana Capital: Web3 Market Report for Q2 2024

Contents

- Market Overview: 4-8

- Key Events in Web3: 9-10

- Hedge Fund Strategies: 11-14

- DeFi Market Analytics: 15-17

- Venture Market Status: 18-29

- Dubai Blockchain Week: 30-33

- Market Trends: 33-44

- Summary: 45-47

- Information About Us: 48-52

Disclaimer

Notification for all interested parties who have received this material. This document has been prepared by Banana Capital LTD. PTE. and, unless otherwise specified, is provided solely for informational purposes. The opinions expressed in this document do not necessarily reflect the views of Banana Capital LTD. PTE. and its affiliates. Differences in opinions arise from various assumptions, sources, criteria, or valuation methodologies. The information and opinions expressed in this document may change without prior notice. Banana Capital LTD. PTE. or any of its branches are not obligated to update the information contained in the document.

This document does not constitute an offer or an invitation to engage in investment activities. It is not an advertisement or an offer of financial instruments. Descriptions of any company, project, or associations, their securities, coins or tokens, markets or developments mentioned in this document do not claim to be comprehensive. The opinions expressed in this document cannot replace individual judgment and are not intended to meet the specific investment objectives, financial situation, or particular needs of any specific investor. The sources used in this document and/or the information have not been independently verified. No guarantees are given regarding the accuracy, completeness, reliability, or suitability for any particular purpose of such information and opinions. The securities and commodities described in this document may not be available for sale in all jurisdictions or to certain categories of investors.

In accordance with ACRA rules and regulations, Banana Capital LTD. PTE. may engage in regulated activities only by its licenses. Financial instruments are subject to price fluctuations, interest rates, and exchange rates, which can negatively impact the value of investments or income derived from them. Please note that past performance is not indicative of future results. Banana Capital LTD. PTE. avoids conflicts of interest within the company or its relationships with clients, service providers, and other stakeholders.

This information cannot be used to create any financial instruments, products, or indexes. Banana Capital LTD. PTE. and its affiliates, directors, representatives, and employees are not liable for any direct or indirect losses or damages resulting from using any information contained in this document. Banana Capital LTD. PTE. operates in full compliance with its internal documents.

Bitcoin Dominance

Over the past three months, Bitcoin dominance has remained in the range of 54 % to 56 %, despite the altcoin market losing around 60 % of its value. TON, ETH, and Solana were the mainstays of the altcoin market, not only enduring the correction but also demonstrating the best returns, especially TON (+56 %).

With the launch of the ETH-ETF expected in July, most Ethereum ecosystem altcoins are believed to have reached their lows. A successful ETF launch could lead to significant profit growth, prompting a reassessment of projects on other blockchains.

Regulation of ETH-ETF

In the second half of May, the U.S. Securities and Exchange Commission (SEC) unexpectedly changed its stance on regulating an Ethereum ETF. By May 23, a deadline was set for reviewing two applications, and market participants were 90 % sure that the applications would be rejected. However, news emerged that the Democratic Party supported the cryptocurrency market. This decision was driven by the fact that about 20 % of Americans, approximately 50 million people, own cryptocurrency. The party aims to garner support from this significant portion of the population, which prompted them to pressure the SEC.

As a result, the likelihood of the ETF being approved increased sharply, and the application was ultimately approved. The price of Ethereum jumped by 24 %, and the overall rhetoric regarding cryptocurrency regulation began to change. Nevertheless, the ETF has yet to be launched, as several bureaucratic procedures need to be completed. Final approval of all necessary forms is expected to be obtained within the next month.

Seasonality Factor

We expect July and August to be favorable months for the markets from a seasonality perspective. The seasonality factor is expected to support market growth until September 2024. The stability of the U.S. stock market during the summer will help the cryptocurrency sector and likely lead to a more positive start for ETH-ETF trading.

Research by Goldman Sachs confirms our hypothesis about positive seasonality in July and August 2024, noting that the S&P 500 is growing much faster in 2024 than in previous election cycles.

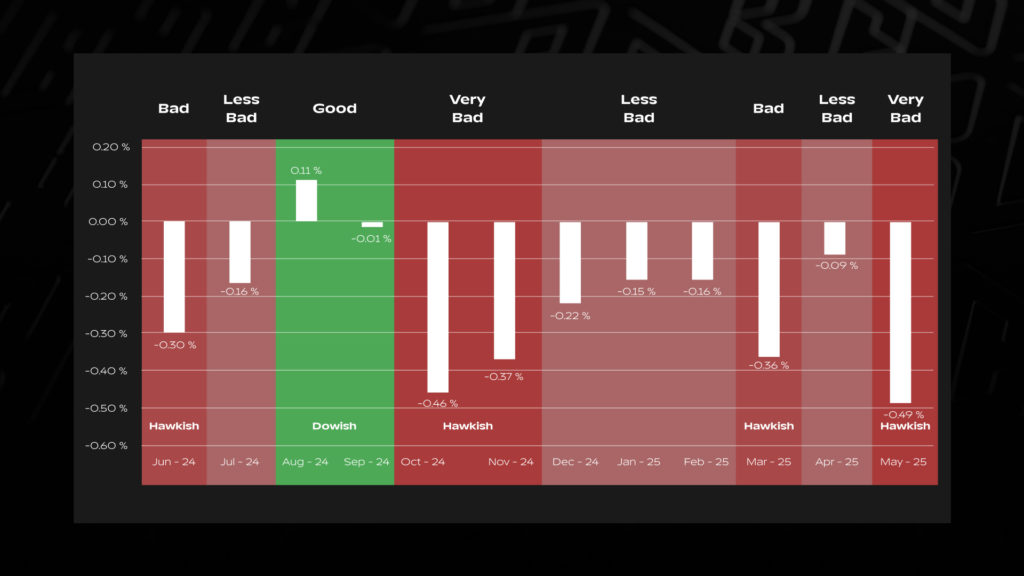

Inflation

The Federal Reserve will begin a cycle of gradual rate cuts in December 2024, six months later than markets anticipated at the beginning of 2023. This delay reflects higher-than-expected inflation in the first quarter of 2024. As economic growth slows and inflation steadily decreases towards the 2 % target, the Fed may conclude that maintaining a longer-term policy outweighs the risk of cutting rates too quickly. The current forecast suggests that the final rate in this easing cycle will be 3.50-3.75 % by 2026. Additionally, the Fed’s balance sheet reduction process will be completed by the end of this year. Despite ongoing risks, the U.S. economy remains strong, and the current outlook is moderately positive.

In June, the Fed left the rate unchanged at 5.25-5.5 %, and the quantitative tightening (Q.T.) policy continues at reduced volumes. Notably, the inflation forecast for 2024 was raised to 2.6 %, and the rate forecast for 2025 was also slightly increased from 3.9 % to 4.1 %.

The current Fed forecast indicates one rate cut this year.

Overall, the Fed’s stance has somewhat tightened in the second quarter. Against this backdrop, markets have adjusted their expectations of an imminent bright future — in other words, no one is in a hurry to start the printing presses.

A study by the analytical company Hedgeye highlights an important point: inflation data will satisfy markets from July to September 2024. However, Hedgeye considers October-November to be highly negative regarding inflation dynamics. This aligns with our market expectations for the third and fourth quarters of 2024: the short-term summer positivity may be replaced by turbulence as early as September-October.

Tether Launches “Pegged Asset” Backed by Gold

Tether, the issuer of USDT, has released a new token, aUSDT, backed by Tether Gold (XAUT). This token is part of a line of “pegged assets” called Alloy.

Alloy represents a new category of “pegged” digital tokens designed to track the price of benchmark assets using stabilization strategies.

This move is part of Tether’s long-term risk diversification strategy, as the company seeks to counter U.S. attempts to dominate the market with USDC. Following Binance’s example, it is evident that any means might be used in this competitive struggle, and Tether aims to minimize potential attack points.

Solana: Major Updates

June was a significant month for the Solana blockchain, thanks to three major updates from the project team:

- Zk Compression Technology: This new technology drastically reduces data storage costs on the blockchain—by up to 5000 times. It is similar to Ethereum’s L2 solutions but without their drawbacks, such as centralized bridges, fragmented liquidity, and poor user experience.

- Blinks and Links Technologies: These innovations allow the integration of on-chain actions within the Solana blockchain into any website. Functions like payments, donations, or voting can now be added directly into web posts, similar to Twitter, without programming or site administration approval. This is a significant step towards simplifying user interaction with the blockchain.

- Colosseum Accelerator: This major accelerator has raised $60 million to support early-stage startups based on Solana, fostering innovation and growth within the ecosystem.

On-Chain Metrics Analysis

Overall, on-chain metrics currently support the potential for mid-term growth rather than indicating capitulation during the recent downturn. This could signal another sharp decline followed by a rapid recovery.

- Stablecoin inflows to exchanges remain stable and high, indicating investors’ readiness to buy the dips.

- BTC outflows from exchanges continue within the $60,000-$70,000 range, suggesting sustained BTC accumulation by investors.

- Net buying power has increased.

- Short-term holders (STH) are back in the negative zone, indicating significant losses among recently acquired BTC.

Liquidity Provision Strategy in DeFi Protocols

At Banana Capital, we employ a liquidity provision strategy within DeFi protocols. Yield is generated through trading fees on decentralized exchanges, maximizing efficiency, especially in volatile markets.

Unlike traditional methods, we utilize hedging to protect positions, ensuring stability and consistent returns. This approach addresses the issue of the underlying asset’s devaluation deposited in the liquidity pool.

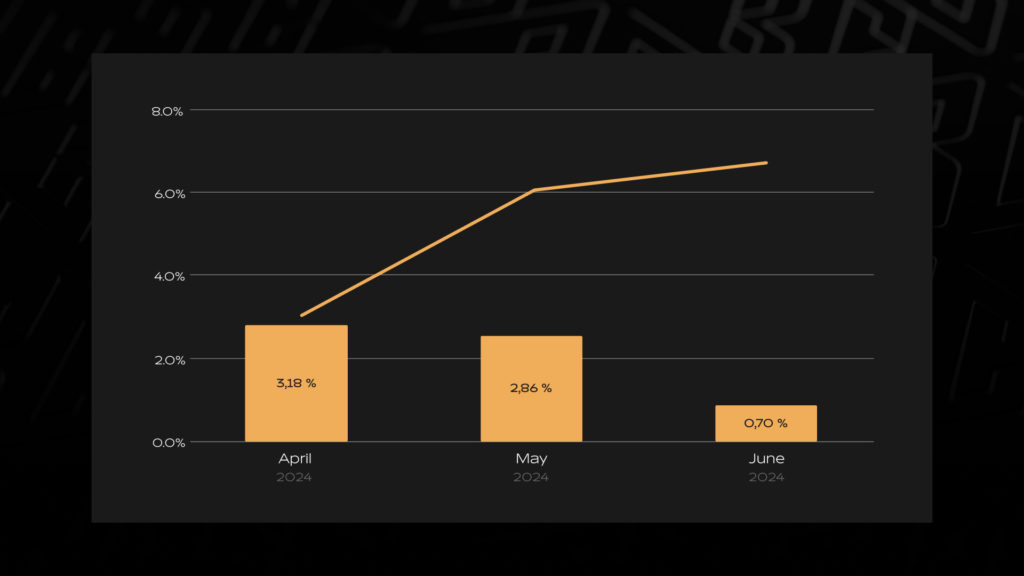

Strategy Yield for Q2 2024

The total yield for this strategy reached 6.74 % for the second quarter of 2024:

- April 2024 – 3.18 %.

- May 2024 – 2.86 %.

- June 2024 – 0.70 %.

Currently, the strategy actively involves increasing the base asset in ETH. For more detailed information about the strategy, please contact our manager: https://t.me/bananacap_bot

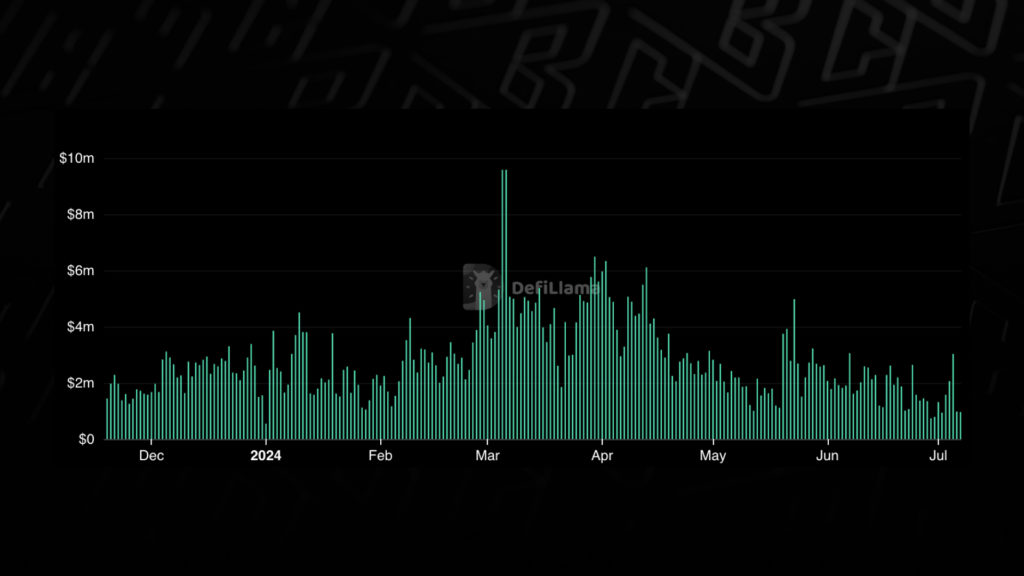

Decreased Trading Activity on DEX

Trading volumes on the Uniswap platform decreased by 35 % in Q2 2024 compared to Q1 2024. Since any liquidity provision strategy on a DEX directly depends on the platform’s fee volumes, these market conditions negatively impacted the profitability of Banana Capital’s flagship DeFi strategy.

Nevertheless, despite the decrease in trading volumes and the increased cost of hedging positions (due to heightened volatility), the Banana Capital strategy demonstrated resilience even in extreme market conditions, achieving a return of 6.74 % in Q2 2024. We are optimistic about Q3 2023, as several factors, including seasonality, favor an increase in trading activity on DEX exchanges in Q2 2024.

Despite the strategy’s decrease in profitability and increased costs due to expensive hedging during sharp market fluctuations, our strategy remains profitable.

This indicates that the strategy is optimized to operate even in the most adverse market conditions. We expect an increase in market activity in the second half of 2024.

As shown on the graph, trading volumes decreased by approximately 35 % in the second quarter due to low trader activity, which inevitably impacted the profitability of our strategy. Currently, we are observing historically low trading volumes.

Enhancing Strategic Mechanics

We continue to enhance our strategy and algorithms, optimize position management, and develop our software. We now can deploy funds and capitalize in ETH, which is particularly relevant in anticipation of the upcoming bull market and beneficial for holders of this asset in our portfolio. We are actively developing I.T. solutions to effectively manage capital and pools, enabling the placement of any portfolio coins.

Our June ETH yield was 2.68 %. For comparison, the yield of native ETH staking through Lido is 2.96 % annually!

The problem with providing liquidity to DEX pools lies in the absence of a single convenient aggregator where you can assess the pools’ state (APR, TVL, Volume, etc.) and choose the most suitable configurations for your strategy. Moreover, timely repositioning is crucial for optimizing pool management, especially with large volumes. We have developed a technical solution that enables us to effectively address these issues.

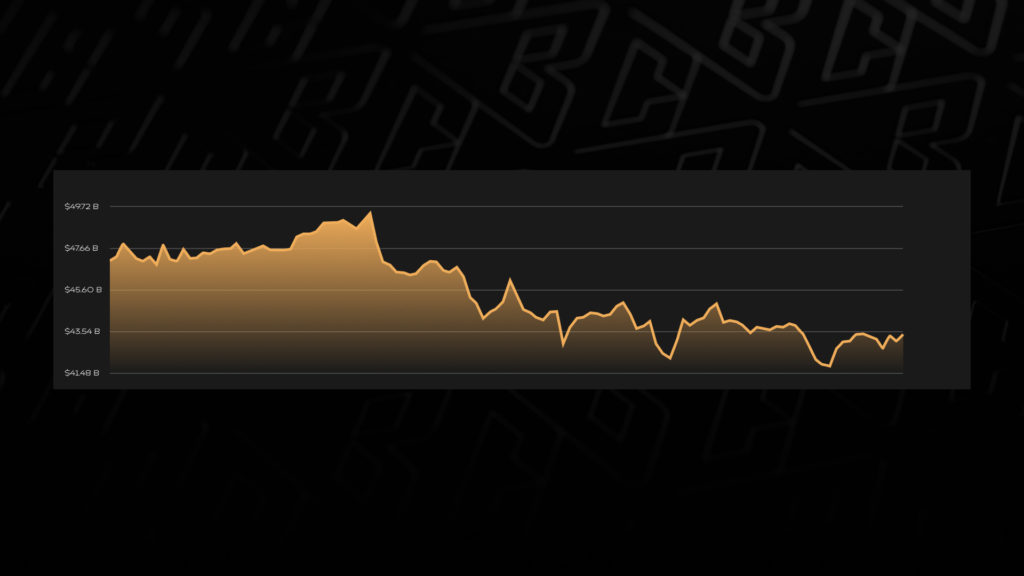

TVL Dynamics in Layer 2 Blockchains

The graph illustrates that the total value locked (TVL) in L2 solutions has decreased by 9 % over the past month. The primary reason for this decline is the unsuccessful token launches by two major projects: Blast and ZkSync.

Following the release of their tokens, liquidity began flowing to other blockchains. The platform Scroll emerged as the primary beneficiary of this process, showing a growth of 153 %. Meanwhile, Blast encountered the most difficulties, losing 31 % of its liquidity after the token release.

Lido and Uniswap: Main Beneficiaries of Growth

Naturally, as Ethereum’s value increased, so did the capitalization of associated projects. Two projects showed significant growth. The first is Lido. In updated ETF applications, most issuers excluded Ethereum staking from their products. This means Lido, which earns through Ethereum staking, will capture a larger market share. Any inflow into an Ethereum ETF post-approval will withdraw this ether from potential staking, reducing the number of participants sharing the pie.

The second project that demonstrated significant growth is Uniswap. Its value increased by 50 %. This is linked to earlier in the year, after announcing profit distribution via its token, Uniswap faced an SEC lawsuit, leading to a 60 % drop. With relaxed crypto regulations and a change in the Democratic Party’s stance on cryptocurrencies, it’s becoming clear that the SEC will likely lose upcoming lawsuits or even abandon them altogether. As a result, the Uniswap token nearly doubled in value.

Stock Market Arbitrage Strategy at Banana Capital

In this strategy, we exploit inefficiencies in the stock market. The strategy enables earning a 6-8 % monthly return on dollar capital while remaining market-neutral (profitability does not depend on the direction of asset price movements). Therefore, arbitrage is a trading strategy that allows for risk-free profit by simultaneously buying and selling assets on different markets when price differences create such opportunities.

Essentially, we act as a “market maker,” eliminating these inefficiencies and aligning asset prices.

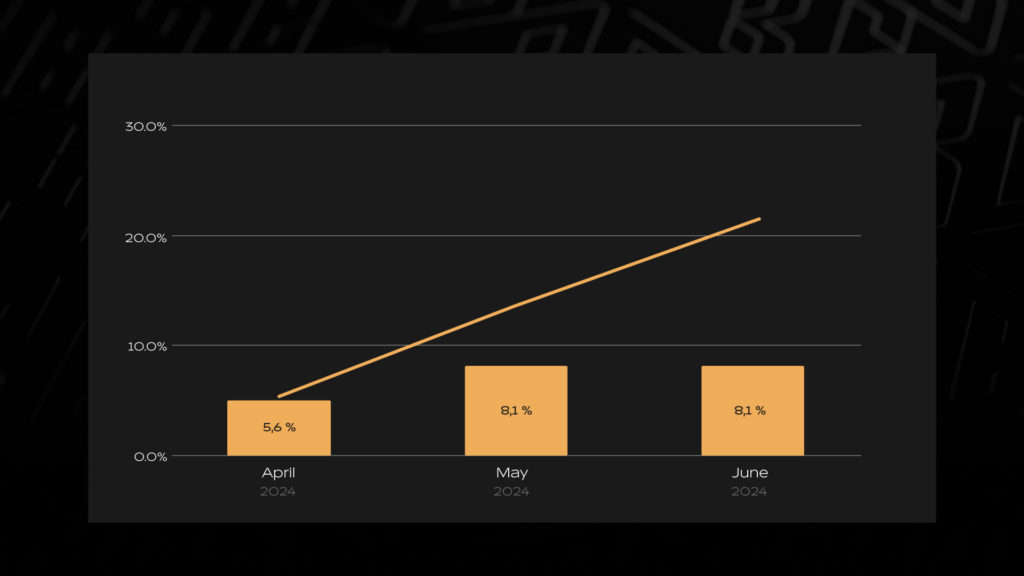

Strategy Yield for Q2 2024

The overall yield of this strategy reached 21.8 % for the second quarter of 2024:

- April 2024 – 5.6 %.

- May 2024 – 8.1 %.

- June 2024 – 8.1 %.

For more detailed information about the strategy, please get in touch with our manager: https://t.me/bananacap_bot

State of the Venture Market in Web3

Projects in our pipeline have shown a linear decrease in FDV (Fully Diluted Valuation) for Q1 and Q2 of 2024. Startups that joined in Q1 of 2024 had an average valuation of approximately $42.6 million. In the Q2 of 2024, this valuation decreased to $35 million.

This decline can be attributed to market expectations of a pre-sale relative to the decline in the price of BTC, the leading asset in the market, expected in Q3 and Q4 of 2024. These lower valuations allow investors to acquire high-quality assets at advantageous prices.

Project Exit Statistics

Due to low ROI upon project exits, they consistently delay TGE dates. The ATH ROI for the second quarter of 2024 reached 770 % (including alpha-behavior statistics from projects like PrivateAI, which achieved 60,000 %). Excluding alpha behavior, the average ROI was 420 %. This reflects a very low profitability level, considering the risks and token lock-ups that investors undertake.

Approximately 213 projects were launched in the second quarter. Among them, 23 startups showed returns of 900 % or higher. The probability of selecting a profitable project stands at 11 %. The most profitable projects in terms of ROI include Donato Creator Token, PrivateAI, Lifeform, Carlo, FreeBnk, Nuklai, and Lista DAO.

The average valuation of all projects in the second quarter was $163 million. The main issue in the current market lies in excessive optimism, leading to overvaluation. Institutional funds play a significant role in injecting money into startups and inflating their FDV. After institutional investors enter, less experienced participants follow the logic of “big players cannot be wrong” and start investing in highly valued projects.

Based on the above, assumptions can be made regarding the current OTC market: many are trying to acquire assets and then sell them in transactions related to Layer Zero, zkSync, Scroll, and others. The end consumers of these transactions are often small funds and syndicates, reselling assets to regular users. This model is only sometimes efficient due to high valuations, which create difficulties when exiting investments.

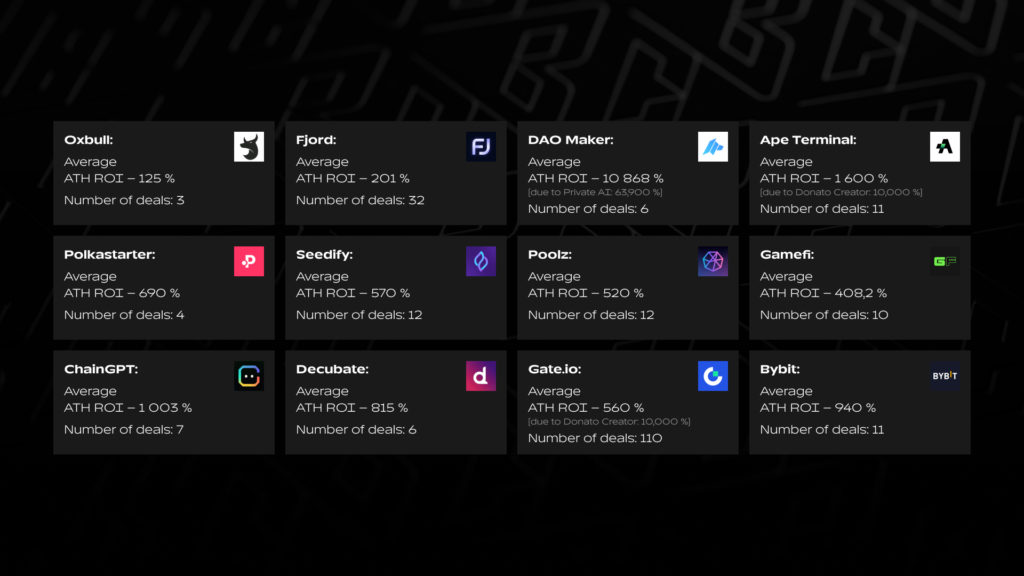

Launchpads Efficiency

- Oxbull: Average ATH ROI – 125 %. Number of deals: 3.

- Fjord: Average ATH ROI – 201 %. Number of deals: 32.

- DAO Maker: Average ATH ROI – 10,868 % (due to Private AI: 63,900 %). Number of deals: 6.

- Ape Terminal: Average ATH ROI – 1,600 % (due to Donato Creator: 10,000 %). Number of deals: 11.

- Polkastarter: Average ATH ROI – 690 %. Number of deals: 4.

- Seedify: Average ATH ROI – 570 %. Number of deals: 12.

- Poolz: Average ATH ROI – 520 %. Number of deals: 12.

- Gamefi: Average ATH ROI – 408.2 %. Number of deals: 10.

- ChainGPT: Average ATH ROI – 1,003 %. Number of deals: 7.

- Decubate: Average ATH ROI – 815 %. Number of deals: 6.

- Gate.io: Average ATH ROI – 560 % (due to Donato Creator: 10,000 %). Number of deals: 110.

- Bybit: Average ATH ROI – 940 %. Number of deals: 11.

Promising Projects

In the Q2 of 2024, our venture division received inquiries for potential investments from 650 projects. We have identified the most promising ones to present as part of our deal flow:

- Storm Trade – the first decentralized platform for derivatives trading on Telegram. Built on the TON blockchain, it allows leveraged trading up to x50. Investors include TONcoin Fund, Yolo, Sky9 Capital, Kangaroo Capital, GotBit, and others.

- CrossCurve by Eywa – a DeFi protocol enabling cross-chain swaps of any assets (LSTs, Stables, Curve L.P.s) with low slippage rates in a single click, leveraging Curve liquidity pools ($2B+ TVL). Investors include Michael Egorov (Curve Finance – Lead), Fenbushi Capital, GBV Capital, Marshland Capital, and others.

- Grindery – creating an EVM Smart Wallet for Telegram using Account Abstractions technology. This eliminates the need to manage passwords and private keys or acquire tokens for blockchain transaction fees. Investors include Binance Labs (Lead), ANKR, MH Ventures, and Gate Labs.

- Futaba – a modular omnichannel interface that facilitates communication between smart contracts, rollups, and blockchains by querying and receiving data from a unified source chain. Investors include Decima and Spurcle, with partnerships including LayerZero, Axelar, Orbiter, Arbitrum, Scroll, Mantle, and others.

- Yarchain – a decentralized blockchain interconnector, offering modular solutions for liquidity migration across blockchains. The project is in the pre-beta stage and has closed its first investment round.

- Kontos – a leader in Account Abstraction (A.A.), with an innovative Layer-2 accounts protocol for managing crypto assets using zero-knowledge (zk) data disclosure technology. Investors include Binance Labs (Lead), Shima Capital, and Spartan Group.

- NettyWorth – a platform for calculating NFT valuations and managing digital assets. It integrates data and tools in one place, providing liquidity access through the loan market and uses A.I. to connect borrowers and lenders, unlocking capital from various assets. Investors include Blockchain Founders Fund (Lead), Acacia, Republic.

- Zoth – an ecosystem bridging liquidity between traditional finance and blockchain, accelerating asset and capital flow efficiently across these sectors. Investors include Blockchain Founders Fund, Borderless Capital, and Outlier Ventures, with partnerships including Coinbase, Budweiser, and others.

- LevelQ Finance – offers advanced quantitative algorithms and provides a seamless user experience, enabling anyone to leverage DeFi opportunities. The project is in the pre-beta stage and has closed its first investment round.

- Shutdown – a Web3 game set in a dystopian universe where artificial intelligence has seized power. Players engage in fast-paced battles, competing globally to capture valuable resources and climb the career ladder in a decentralized society. Investors include Magnus Capital, Bitscale, Morningstar Ventures, and others.

- Gatenow – a comprehensive compliance and verification center for Web3 organizations. Their AI-based platform optimizes corporate KYC processes, integrating all parts of client onboarding into a unified solution. Investors include A100x, Blockchain Founders Fund, and others.

- Velvet Capital – the future of DeFi. The project offers a frictionless way to create, manage, and launch intrachain funds, structured products, and tokenized portfolios! It also provides essential infrastructure for asset management on the blockchain. Investors include Binance Labs, Gate Labs, Cointelegraph Ventures, and others.

- Indexing – a Web3 cloud data storage service. Their flagship product, Data 3.0, provides complete data storage infrastructure that can save over 50% of the budget and regain control over all data. Investors include Palm Tree and Orange DAO.

- Orb – a social network based on the Lens protocol. Leveraging blockchain technology, Orb allows users to own their publications and follower base, transferring them seamlessly through the Lens ecosystem. Investors include Founders Inc, Foresight Ventures, Stani, Sandeep, and others.

For more information about these projects or our investment strategy, please get in touch with our manager: https://t.me/bananacap_bot

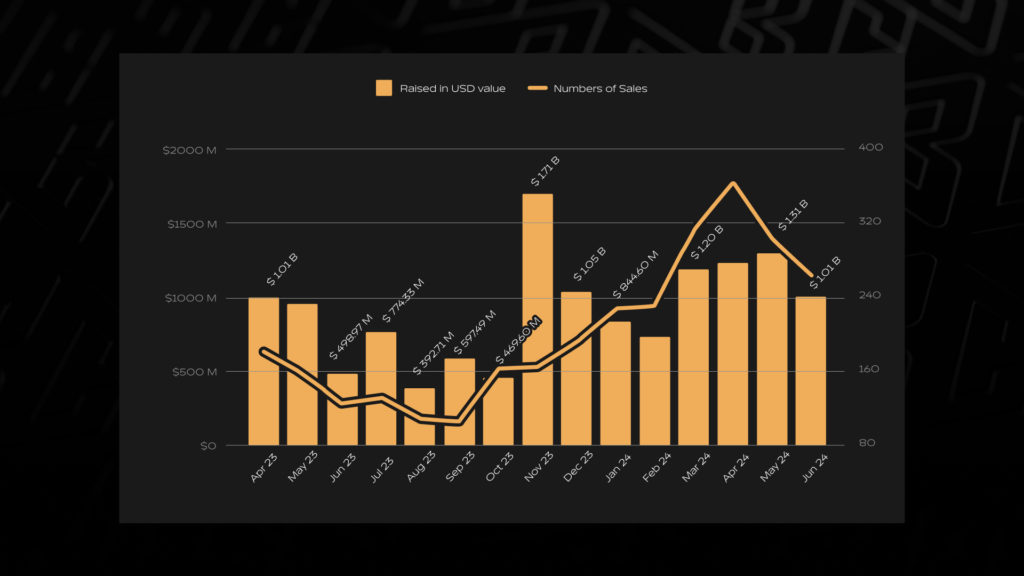

Venture Deal Statistics in Web3

In Q2 of 2024, we observed many recent deals within the Web3 sector. At the same time, the fundraising curve has stabilized, indicating sufficient liquidity in the primary market. According to experts, the main segments of the market for project exits into the secondary market include DeFi, Gamefi, and Blockchain Service sectors.

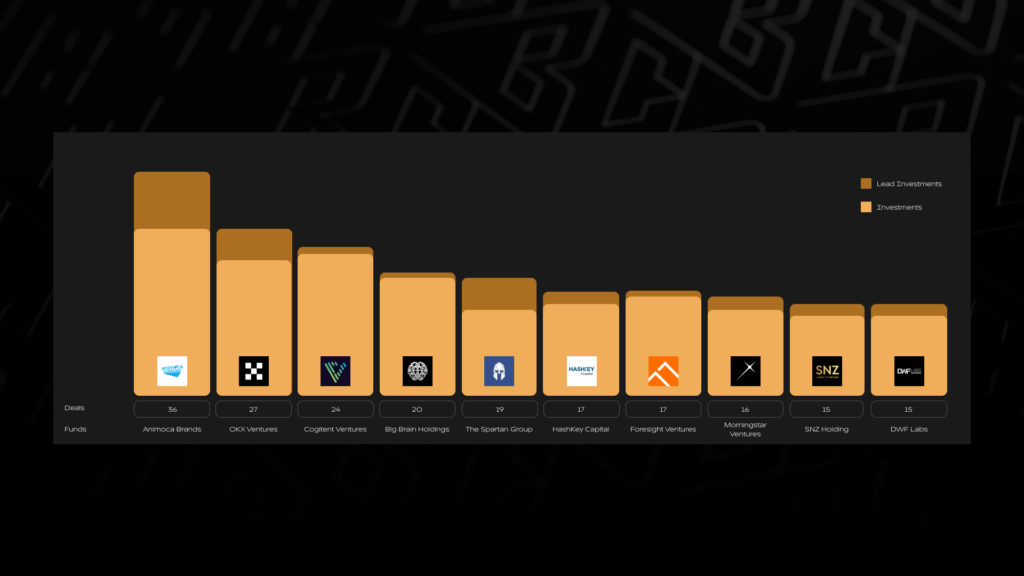

Most Active Venture Capital Funds

Largest Venture Deals

- Monad – Raised $225 million. Investors: Paradigm (Lead), DragonFly (Lead), Electric Capital, Shima Capital, OKX Ventures, Placeholder, and others. Monad is a Layer-1 blockchain utilizing transaction parallelization, achieving over 100 transactions per second speeds. One of its key features is full compatibility with EVM, leveraging Ethereum’s extensive developer infrastructure. Currently, in the testnet phase, the project is expected to launch by the end of the year or in the first quarter of 2025.

- Berachain – Raised $115 million. Investors: Polychain (Lead), Framework Ventures (Lead), Hashkey Ventures, and others. Berachain is a Layer-1 blockchain designed to enhance scalability and interoperability in the blockchain industry. It employs a hybrid consensus mechanism combining elements of PoS (Proof of Stake) and PoL (Proof of Liquidity), ensuring high transaction speeds, improved security, and additional income opportunities for validators.

- Farcaster – Raised $180 million. Investors: Paradigm (Lead), a16z, Coinbase, Multicoin, etc. Farcaster is a decentralized social network built on blockchain that aims to improve transparency and user control over their data. Its distinguishing feature is that it gives users full control over their personal information and content without interference from centralized administrators. Project development is ongoing, with the first platform version planned for release by late 2025.

- Babylon – Raised $70 million. Investors: Hashkey Capital, Paradigm, Polychain, HTX Ventures, Hack VC, IOSG Ventures, and others. Built on Cosmos, Babylon aims to enhance the security of Cosmos zones and other networks using Bitcoin’s security model via PoS consensus. PoS networks can achieve Bitcoin-level security by using Babylon’s slow finality method. To confirm a transaction using slow finality, PoS chain clients wait until the timestamp of the PoS block containing the transaction becomes k-deep in Bitcoin. This ensures transaction security against costly double-spending attacks.

Deal and Round Structure

Analyzing the data presented on the slide, it is noticeable that strategic rounds with investments ranging from $1 to $3 million are gaining increasing importance. At the same time, the volumes of investments in later rounds with higher amounts are decreasing.

This indicates that institutional investors remain uncertain about the long-term market outlook and are beginning to implement risk mitigation strategies by limiting investment amounts in later rounds.

Investment Overview: Consensys

In Q2 of 2024, we invested in Consensys, a leading blockchain and Web3 software company. Since 2014, Consensys has been at the forefront of innovation, leading technological developments within the Web3 ecosystem. Their products include platforms such as MetaMask, Infura, Linea, Diligence, and others. Their primary mission is to inspire and expand developer capabilities, making Web3 universally user-friendly.

The project attracted investments totaling $725 million, with a valuation in its latest round reaching $7 billion. Among the investors are Tier-1 funds such as BlackRock, J.P. Morgan, DragonFly Capital, The Spartan Group, Coinbase Ventures, ParaFi Capital, and 34 other funds. We are proud to be investing alongside such prominent funds!

You can invest in the most promising projects with us – for more information about our strategy, please get in touch with our manager: https://t.me/bananacap_bot

Blockchain Week Dubai

Participation in global conferences has demonstrated strategic importance in marketing and business development. Attending conferences is crucial for building an extensive network, increasing brand visibility, and attracting clients and investors.

That’s why, in April 2024, we attended some of the largest conferences in the Web3 industry in Dubai, UAE. Over 400 speakers took the stage at six conferences, with an audience exceeding 20,000 attendees, alongside more than 500 side events.

With the Banana Capital team, we showcased firsthand what the best Web3 conferences in the world look like. You can learn more about our trip in this article.

List of Attended Conferences

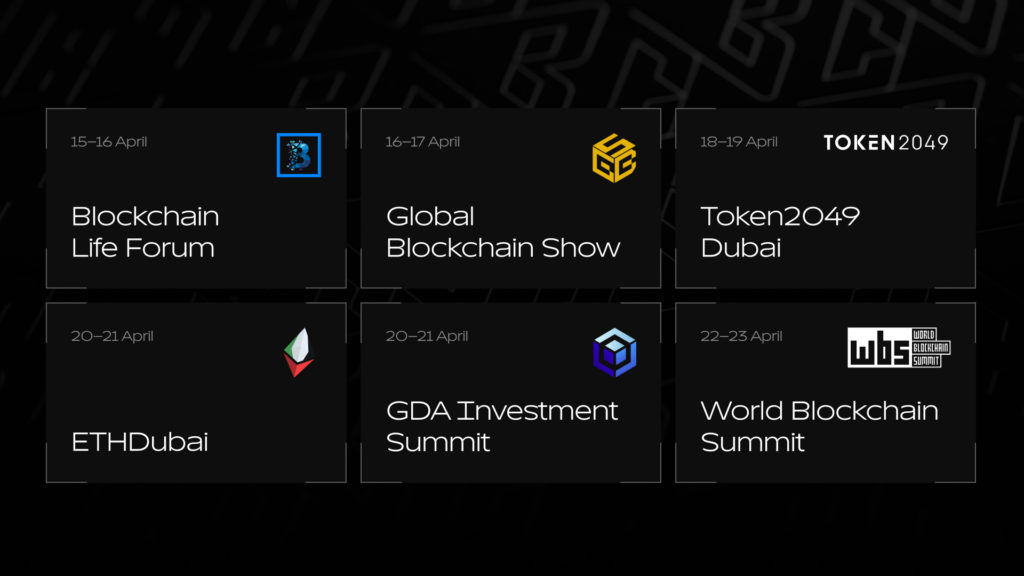

During Blockchain Week Dubai, a series of 6 leading conferences took place, featuring key figures and thought leaders from the cryptocurrency and blockchain industries:

- Blockchain Life Forum (April 15-16, Festival Arena)

- Global Blockchain Show (April 16-17, Grand Hyatt)

- Token2049 Dubai (April 18-19, Madinat Jumeirah)

- ETHDubai (April 20-21, Le Meridien Center)

- Global Digital Assets Investment Summit (April 20-21, Atlantis, The Palm)

- World Blockchain Summit (April 22-23, Address Marina)

Result of the Dubai Trip

Dubai served as a vibrant backdrop for networking: luxurious venues, headquarters, rooftop settings, trendy restaurants in skyscrapers, and stylish cocktail bars. Blockchain Week, we highlighted Dubai’s position as the crypto capital of the Middle East, a futuristic city amidst the desert.

- We established over 550 contacts throughout our work, fostering new connections and partnerships for our clients.

- Subsequently, we created over 250 partnership chats, predominantly with other investment funds for deal flow.

- Thanks to the Dubai trip, our investment fund gained significant social media traction: LinkedIn (5,200) and Twitter (7,300) followers. We made a strong initial impact. Our total audience now consists of 1,216 followers.

- Most importantly, the investment fund has acquired new substantial potential investors (LPs), with whom we plan to negotiate and initiate partnerships only with the best.

All the events we attended were focused on sharing expertise rather than consuming it. Educational seminars and panels were aimed at learning, not sales – from technical deep dives into smart contracts to discussions on regulatory compliance and security. Over 13 days, our team gained a wealth of practical knowledge and skills.

Analysis of Projects After Conference Attendance

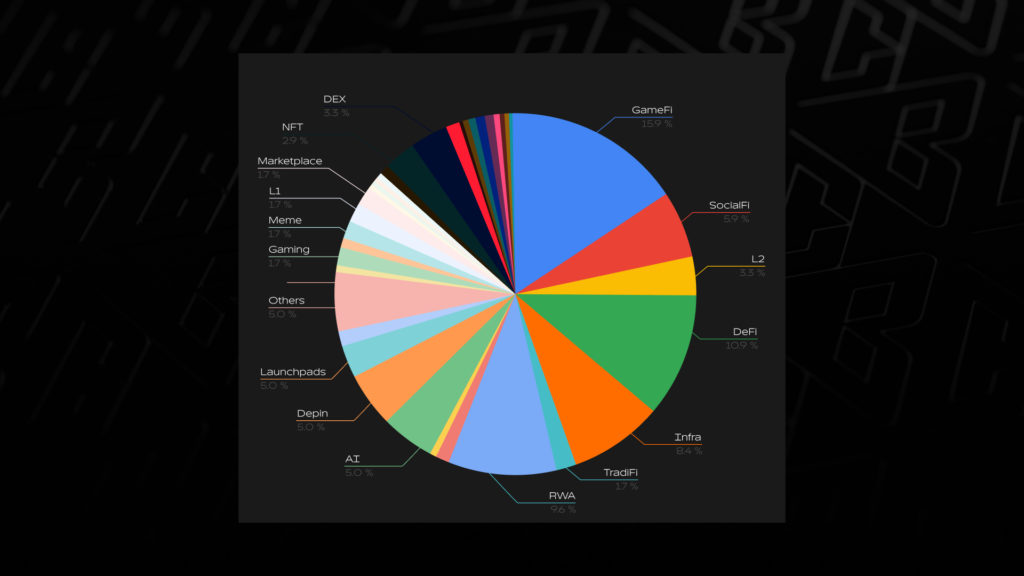

For the venture arm of our fund, we evaluated 246 projects for potential venture investment. Among them, 19 projects (7.7 %) piqued our interest, 15 projects entered our deal flow pipeline, and 212 projects (86.1 %) were rejected.

Projects in segments such as GameFi, RWA (Real-World Assets), Infrastructure, and DeFi predominated. This reflects significant interest from major funds and institutional investors.

RWA gained popularity following the adoption of ETFs. Regarding DeFi and GameFi, there’s anticipation that these projects will undergo a resurgence and address the shortcomings of previous generations, including tokenomics adjustments, business models, and audience engagement. Infrastructure projects remain in demand as no ecosystem is perfect, and startups strive to address existing deficiencies and meet user needs.

Conclusion After Project Analysis

The venture capital market is in an ambiguous position despite the record amount of funds raised recently. This is due to large funds’ restructuring of the deal process towards risk reduction (hedging), lower valuations, and low ROI across the market. The low financial performance is primarily related to the unreasonably high valuations of projects by FDV (over 100 million dollars).

Without clear positive momentum, the secondary market hesitates to invest in large projects with fully diluted valuations (FDV) of $100 million. This explains the low exits and the downward trends in such projects.

Major capital is awaiting changes with the arrival of projects in GameFi, RWA, Infrastructure, and DeFi sectors. These segments have the potential to disrupt and reshape existing market paradigms.

Prominent and “quality” launchpads often refrain from launching new projects as they, too, are uncertain about the market’s direction. Volumes and deal numbers are driven towards projects with low FDV that are launched on corresponding launchpads.

Market Trends

Sentiments and trends in Web3 are constantly evolving. Several key narratives accompany each bullish market:

- 2017-2019: ICOs, Layer-1 blockchains, decentralized storage, and cross-chain bridges.

- 2020-2022: DeFi, NFTs, and GameFi.

After attending conferences, it takes time to predict future Web3 trends with certainty. Still, we can approximate what the next bullish market might look like by analyzing current trends and characteristics. We have identified several narratives for the next bull run that are frequently discussed among venture investment funds: AI, LRTs (Layer-1 Rollups), DeFi, GameFi, Infrastructure, DePIN (Decentralized Private Investment Networks), and RWA (Real-World Assets).

Tokenization of Real-World Assets (RWA)

The tokenization of real-world assets bridges the physical and digital worlds, eliminating the need to rely on traditional governmental institutions for transactions. Key advantages of digital financial assets include:

- Accessibility: Lower entry barriers through asset fractionalization.

- Speed: Blockchain operates more efficiently in terms of transaction speed and reduced fees.

- Security: Blockchain, while anonymous, offers complete transparency.

- Proof of Authenticity: NFT and SBT technologies track transaction paths and establish true ownership.

The RWA sector aims to tokenize if not all, then a significant portion of assets. The total size of tokenized assets, including real estate and natural resources, could reach $16.1 trillion by 2030. Source: “Relevance of on-chain asset tokenization in ‘crypto winter’” from consulting firm BCG.

Liquid Restaking (LRTs)

The primary advantage of restaking is the ability to reuse ETH within the Ethereum main network or in liquid staking pools as wrapped tokens on platforms utilized by the EigenLayer protocol. With liquid restaking services, EigenLayer transforms from a unique protocol into an entire ecosystem capable of establishing a conceptually new model for blockchain application security. Key benefits of this approach include:

- Increased yield from held ETH.

- New methods of participation in DeFi protocols.

- Incentives and rewards from all links in the liquid restaking chain.

One of the key growth drivers for interest in restaking is the increased staking yield for ETH and the expectation of rewards from EigenLayer itself and DeFi protocols such as Renzo, KelpDAO, EtherFi, Puffer.fi, Eigenpie, and others.

Decentralized Physical Infrastructure Networks (DePIN)

DePIN is a novel concept that integrates blockchain technologies with physical infrastructure objects. This technology enables people to earn rewards for providing various infrastructure networks, such as computational power, free disk space, and more. DePIN is divided into two main categories:

- PRN (Physical Resource Network) incentivizes users to utilize equipment to provide goods and services in the real world, such as 5G, VPNs, and others.

- DRN (Digital Resource Network) rewards those who use equipment to create real physical infrastructure networks for digital resources.

This technology operates at the intersection of blockchain and the physical world, and top financial funds believe in its potential success. DePIN is expected to play an increasingly vital role in developing our physical world as technologies evolve and new use cases emerge.

In the world of Web3, the DePIN sector empowers individuals to enhance public infrastructure through simple actions and receive rewards for it. This direction is promising and holds significant potential.

Some of the most popular DePIN projects include Render, Fluence, Filecoin, Natix, Helium, Grass, Ator, Theta, Akash, Hivemapper, and others.

Account Abstraction (AA)

The update to ERC-4337 has introduced a new standard for wallets on the Ethereum network through the concept of account abstraction — dividing the process into several parts that operate independently. Before the update, there were two types of cryptocurrency wallets:

- External Owned Accounts (EOA) — wallets controlled by users who possess a private key. Examples include Metamask, Phantom, Rabby, and others.

- Contract Accounts (C.A.) — wallets controlled by smart contracts or with pre-defined conditions in code format. Examples include Safe, Argent, Blocto, and others.

The smart account became a third type, a compromise between the two options. Account abstraction has allowed the combination of the advantages of EOAs and C.A.s, such as creating a wallet in the form of a smart contract that facilitates confirmation without using a seed phrase.

Now, anyone unfamiliar with Web3 and cryptocurrencies can create their cryptocurrency wallet with just a few clicks. This technology holds immense potential as it enhances user experience and attracts more enthusiasts to the Web3 world. Full account abstraction can be expected in the future. These promising developments will undoubtedly be key in shaping the digital landscape.

Popular projects utilizing this technology include Alchemy, Argent, Blocto, and Cyber. Cryptocurrency wallets such as Patch Wallet, Avocado, Ambire Wallet, Soul Wallet, Bravoos, Safe Wallet, UniPass Wallet, and Fuelet also employ this technology.

Artificial Intelligence (AI)

In 2023, artificial intelligence breakthroughed, impacting all spheres of activity, including Web3. Technology continues to advance each year, requiring increasingly more computational resources. A.I.’s primary advantage is significant resource savings, which has addressed existing challenges.

A.I. projects on blockchain include SingularityNET ($AGIX), Ocean Protocol ($OCEAN), Fetch.ai ($FET), Solidus ($AITECH), Delysium ($AGI), The Graph ($GRT), and others.

Integrating artificial intelligence in cryptocurrencies enhances data analysis and generates personalized recommendations, making user interaction with the internet more convenient and fostering innovative digital solutions.

With the increasing availability of data and the development of A.I. technologies, Web3 will continue integrating and enhancing this technology. Shortly, we can expect more complex systems capable of predicting needs and offering solutions based on data analysis.

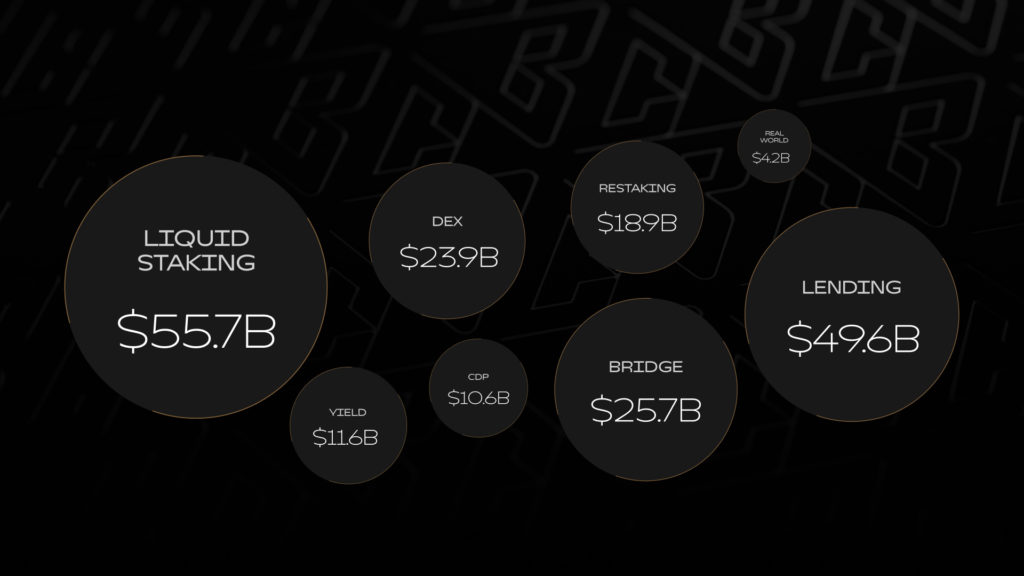

Overview of DeFi Sectors

DeFi (Decentralized Finance) is a rapidly evolving ecosystem of financial applications and services built on blockchain and smart contracts. In 2024, the DeFi ecosystem continues to grow rapidly, demonstrating significant Total Value Locked (TVL) across various protocols on the blockchain:

- Liquid Staking: $55 billion TVL.

- Lending Protocols: $49 billion TVL.

- Blockchain Bridges: $25 billion TVL.

- New DeFi Trend, Liquid Restaking: $18 billion TVL.

- Real World Assets (RWA): $4 billion TVL.

The DeFi market has tremendous potential to transform the financial system, making it more decentralized and transparent. However, it is exposed to risks and requires the development of reliable infrastructure to ensure adequate security and user protection.

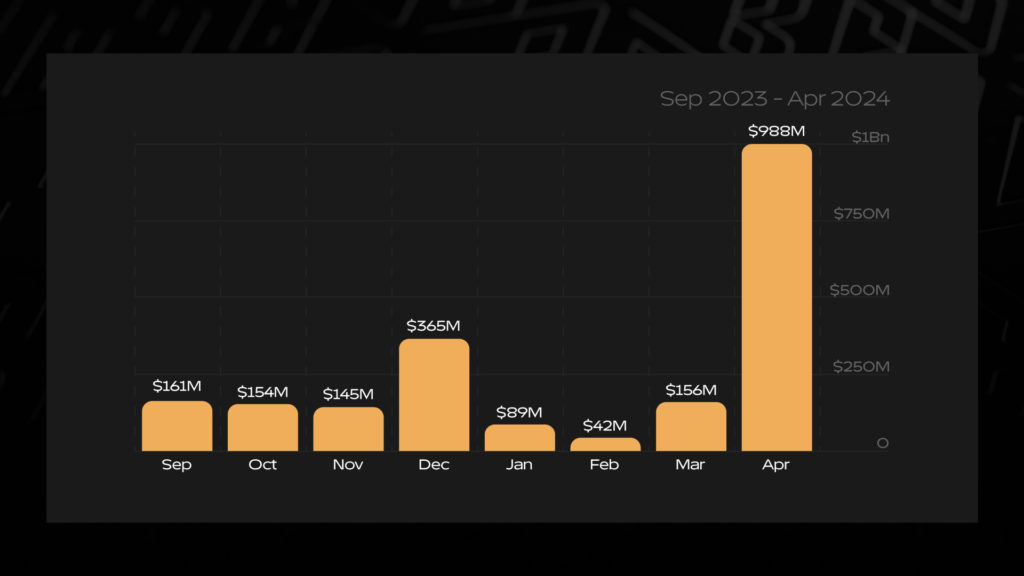

Rise of GameFi Favored by Major Capital

GameFi refers to games that integrate gameplay mechanics, blockchain technology, and NFTs, allowing players to earn cryptocurrency rewards simply by playing. The gaming industry has long been stagnant but is now on the rise, with many investors backing these projects due to their immense potential:

- The GameFi sector has reached 2.9 million daily unique active wallets, accounting for 28 % of overall dApp activity.

- Investments in the GameFi sector peaked at $988 million in April, marking the highest figure since January 2021.

- Cumulatively, investments in the GameFi sector for the first quarter of 2024 totaled over $1.2 billion.

This record influx of investments comes at a crucial moment for the GameFi industry, affirming confidence in its growth trajectory and highlighting the crucial role of venture capital in supporting the industry during challenging times. Moreover, strategic moves by industry giants like Ubisoft underscore a promising future and the sector’s potential.

Market Analysis of GameFi

We have analyzed the GameFi segment, encompassing 80 % of all projects that received investments in 2022-2023, utilizing data from Cryptorank and Dropstab. The study included analysis based on four key metrics: current project status, development stage, connection to the crypto market, and project type.

130 projects were studied, with a total investment volume of $3.1 billion. Most investments (85 %) came in 2022, during the peak interest in Stepn, which drove significant investments into the sector. In subsequent years, interest from venture investors declined.

Regarding project status, 90 % have already entered the market, including 83 launched and 7 closed projects. This indicates that major investments have already been deployed into the market but have yet to stimulate growth in the GameFi segment significantly. It was also noted that 34 % of projects initially associated with crypto themes removed any mentions related to the crypto industry by 2024.

Based on this data, the segment’s primary resource potential has already been realized in the market, giving us a window of 3-6 months for significant segment growth. If such growth is observed, it can confidently be stated that GameFi needs more prospects in the current market cycle.

Meme Coins: Hype or Scam?

This is a unique phenomenon in the Web3 world. Leveraging the power of internet culture and poking fun at the seriousness of the crypto industry, these cryptocurrencies often emerge based on internet jokes, viral trends, or references to popular culture.

- Popular Meme Coins: Key targets of investment for major players include projects like Dogecoin (DOGE), Shiba Inu (SHIB), Floki (FLOKI), Baby Doge Coin (BABYDOGE), PEPE Coin (PEPE), and Memecoin (MEME).

- Why they are bought: The primary advantage of meme coins is their community. Due to their popularity and hype, they attract more people from the Web2 space. For instance, the recent Notcoin (NOT) attracted over 35 million users in just 4 months thanks to its simple concept.

Institutional investment in meme coins is also becoming more active in cryptocurrency. Their active participation in this market segment could lend additional legitimacy and stimulate increased interest.

Overview of the Tap & Play Trend

In early 2024, the first tap game, NotCoin, officially launched on Telegram. Within 4 months, the project attracted over 35 million active users, and the NOT token successfully debuted on tier-1 exchanges, entering the top 100 coins by market capitalization. The hype surrounding the project has sparked a trend of similar applications:

- Hamster Combat – Currently the most popular project, boasting an audience of over 200 million users. Developer details are undisclosed.

- Tapswap – Similar to the buzz around NotCoin, but planned for release on the Solana network. Developer details are undisclosed, with a partnership with Binance Web3 Wallet.

- Blum – Planned as a hybrid crypto exchange on Telegram, led by former Binance top managers and supported by Binance Labs.

- Yescoin – A casual mini-game on Telegram aiming to become the leading meme infrastructure on the TON blockchain. Developer details are undisclosed.

- MemeFi – A PvE tapping game featuring bosses, with partnerships from L2 network Linea by Consensys and Galxe. Developer details are undisclosed.

- Dotcoin – Conceptually similar to Notcoin and Tapswap, adding some unique features. The anonymity of the project team raises concerns.

- Hot – Central to the NEAR ecosystem within Telegram. Near Protocol offers a non-custodial wallet (Near Wallet) and HOT tokens to be traded on exchanges.

- xBlast App – Similar to HOT, but on the Blast Layer2 network. Users farm wXBL tokens, which can be exchanged one-to-one for XBL tokens.

Tap games involve collecting or accumulating virtual coins by simply tapping on the screen and earning coins with each tap.

Articles at Banana Capital

At Banana Education, our articles provide everything newcomers need to dive into the blockchain world. We make it easy and engaging to understand complex concepts, and each of our articles represents a significant step in cryptocurrency education.

Our mission is to explain cryptocurrency and blockchain technology in simple terms. We provide concise and clear information about Web3 for those eager to explore blockchain technology. In the second quarter of 2024, we published 11 articles:

Original Articles

- The History of Banana Crypto

- Rethinking Investments with Banana Capital

- Blockchain Week Dubai

- Banana Capital: Web3 Market Report for Q1 2024

Educational Articles

- Banana Education: The Leading Crypto Guide for Beginners

- Blockchain Technology: What We Need to Know?

- The Blockchain Chronicles: The Technology That Changed the World

- From Static Websites to Owning Content: The History of the Internet

- Web 3: The Path to a Decentralized Internet

- Bitcoin: How and Why the First Crypto Emerged

- Crypto: The Essentials About Digital Money

Summary

Despite a market-wide downturn in June, our strategies confirmed their “delta-neutral” status by showing positive results. For instance, our stock market inter-exchange arbitrage strategy generated 21.8 % for the quarter, and the profitability of the liquidity provision strategy in DeFi protocols yielded 6.74 %.

Q2 of 2024 proved challenging for the crypto market despite significant positive events in May, including the approval of an Ethereum ETF and a sharp shift in U.S. policy toward supporting the crypto industry. Due to several key factors, major cryptocurrencies corrected by 15-20 %, and second—and third-tier altcoins by 35-50 %.

The first factor was the traditionally low summer activity, as many investors and traders go on vacation, leading to decreased trading volumes and market liquidity.

The second factor was the uncertainty surrounding the possible sale of a large volume of bitcoins by the U.S. government and upcoming payouts to affected bitcoin holders from Mt.Gox, creating additional market pressure. Large sales lead to a drop in bitcoin prices, which traditionally pulls down the entire altcoin market.

Moreover, high expectations for significant projects like LayerZero, zkSync, and Blast were not met. Their launches were much worse than expected, exacerbating the market’s negative sentiment and contributing to a deep correction.

Despite current difficulties, the market’s fundamental indicators are in the best state in its history. The technological foundation, infrastructure development, and institutional investment level have reached their peak.

This quarter, the Ton blockchain, the first major blockchain integrated into the Web2 messenger Telegram with an audience of 900 million people, demonstrated strong positive dynamics, standing out against the general market trend. Additionally, Solana introduced several significant solutions, such as Blinks and Links, which could simplify the user acquisition process in the industry, minimizing the usual complexities. These developments could accelerate the integration of new users and promote broader adoption of blockchain technologies.

The upcoming quarters will be crucial for the industry, especially considering the dynamics of inflows into the new Ethereum ETF, scheduled to launch in early July. This fund could attract significant investments and shift the market balance. Another key factor is the payout plan for those affected by Mt.Gox, which could remove some uncertainty and strengthen investor confidence.

If the launch of the Ethereum ETH-ETF is successful and the market adapts to the Mt.Gox payouts, the last significant negative factor in the industry will be eliminated. Strategically, this will create the prerequisites for establishing a long-term positive trend in the cryptocurrency market.

If you want to thank us for our work, please share this report with your friends and subscribe to our social media. If you are interested in our products, you can contact the fund manager at https://t.me/bananacap_bot

Introducing Banana Crypto

The story of Banana Crypto began in 2017, and since then, we have grown into a team of 70 employees and developed an extensive ecosystem. We have expanded our product portfolio through several business directions, including:

- Banana Crypto: An international company operating in 14 cryptocurrency sectors with 7 business directions.

- Banana Capital: A full-cycle investment company: hedge fund, venture capital arm, and incubator, specializing in Web3 projects.

- Banana Labs: A venture investment platform connecting investors with promising Web3 projects in their early stages.

- Banana Nodes: A division providing various services for a strategic approach to passive venture investing in early-stage Web3 projects.

- Banana Alliance: A community of enthusiasts engaged in various activities to generate income in the Web3 market.

- Banana Media: A media hub providing up-to-date information and trends on the Web3 market.

- Banana University: A Web3 educational platform aimed at individuals with varying levels of knowledge.

- Banana Assistance: A division providing financial support to clients and advisory services.

What is Banana Capital?

A full-cycle investment company: hedge fund, venture capital arm, and incubator specializing in Web3 projects.

Banana Capital’s history began in 2017 within a family office, where we actively invested our own capital. Over time, our strategies have demonstrated stability and high profitability in any market conditions.

Despite our emphasis on risk control and asset allocation, our investment returns surpass the U.S. Venture Capital Index and CCI30. Even in conditions of high volatility and cyclicality in the Web3 market, our strategies enable capital growth yearly, regardless of market cycles.

Goal and Mission

- For Investors: We aim to assist investors in safely managing capital, diversifying risks, and consistently achieving high returns regardless of the Web3 market dynamics.

- For Founders: We provide support to project founders not only through financial backing but also by offering assistance in early-stage incubation.

- Our Team: Leveraging years of experience, we serve as gateways for investors to opportunities for safe capital expansion.

- Our Mission: We strive to contribute to the development of the Web3 market, employing secure yet high-yielding investment strategies.

Our Advantages

- We offer portfolio creation and management services tailored to your needs, risk profile, capital volume, and investment horizon.

- We offer investors the opportunity to earn money in the cryptocurrency market using the same strategies we employ to grow our own capital.

- Since 2017, our strategies have demonstrated stability under any market conditions, outperforming the U.S. Venture Capital Index and CCI30 in terms of investment returns.

- We are confident in the effectiveness of our strategies, so the majority of our commission structure is based on success fees. Our primary principle is simple: «We earn when the investor earns.»

- In the venture capital sphere, we don’t limit ourselves to investment; we also act as incubators, enhancing the value of projects and stimulating their growth.

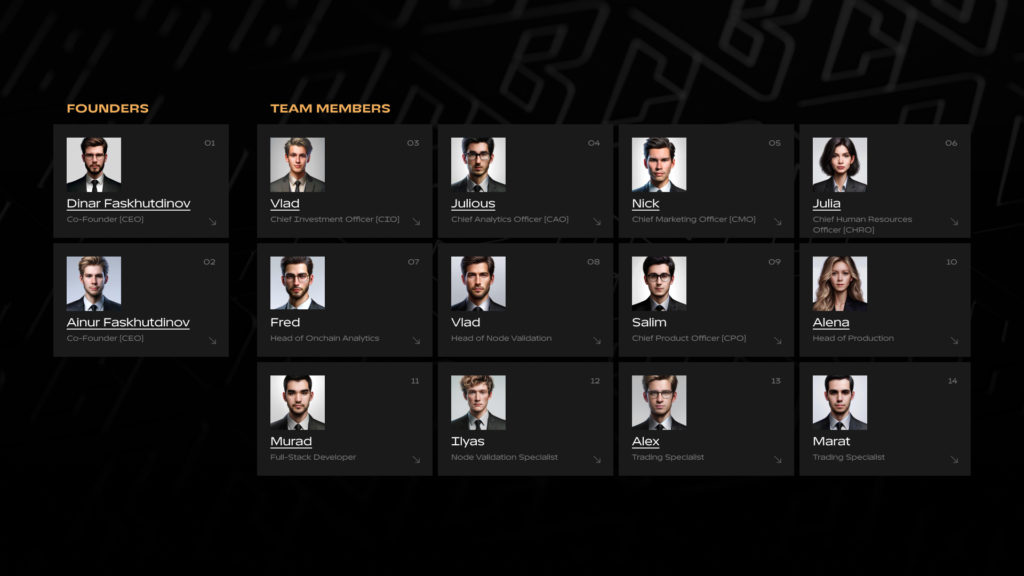

Our Team

In the financial realm, each company serves as a place where not only money converges but also individuals’ deep knowledge, experience, and professionalism. While predicting trends and making informed decisions are crucial in financial markets, teamwork plays a significant role.

Banana Crypto boasts a team of over 70 individuals, each contributing to the company’s overall success and prosperity.

Contact Information

- Email: [email protected]

- Telegram: https://t.me/bananacap_bot

Joining Us?

Joining Us?