Banana Capital: Web3 Market Report for Q1 2024

Disclaimer

Notification for all interested parties who have received this material. This document has been prepared by Banana Capital LTD. PTE. and, unless otherwise specified, is provided solely for informational purposes. The opinions expressed in this document do not necessarily reflect the views of Banana Capital LTD. PTE. and its affiliates. Differences in opinions arise from various assumptions, sources, criteria, or valuation methodologies. The information and opinions expressed in this document may change without prior notice. Banana Capital LTD. PTE. or any of its branches are not obligated to update the information contained in the document.

This document does not constitute an offer or an invitation to engage in investment activities. It is not an advertisement or an offer of financial instruments. Descriptions of any company, project, or associations, their securities, coins or tokens, markets or developments mentioned in this document do not claim to be comprehensive. The opinions expressed in this document cannot replace individual judgment and are not intended to meet the specific investment objectives, financial situation, or particular needs of any specific investor. The sources used in this document and/or the information have not been independently verified. No guarantees are given regarding the accuracy, completeness, reliability, or suitability for any particular purpose of such information and opinions. The securities and commodities described in this document may not be available for sale in all jurisdictions or to certain categories of investors.

In accordance with ACRA rules and regulations, Banana Capital LTD. PTE. may engage in regulated activities only by its licenses. Financial instruments are subject to price fluctuations, interest rates, and exchange rates, which can negatively impact the value of investments or income derived from them. Please note that past performance is not indicative of future results. Banana Capital LTD. PTE. avoids conflicts of interest within the company or its relationships with clients, service providers, and other stakeholders.

This information cannot be used to create any financial instruments, products, or indexes. Banana Capital LTD. PTE. and its affiliates, directors, representatives, and employees are not liable for any direct or indirect losses or damages resulting from using any information contained in this document. Banana Capital LTD. PTE. operates in full compliance with its internal documents.

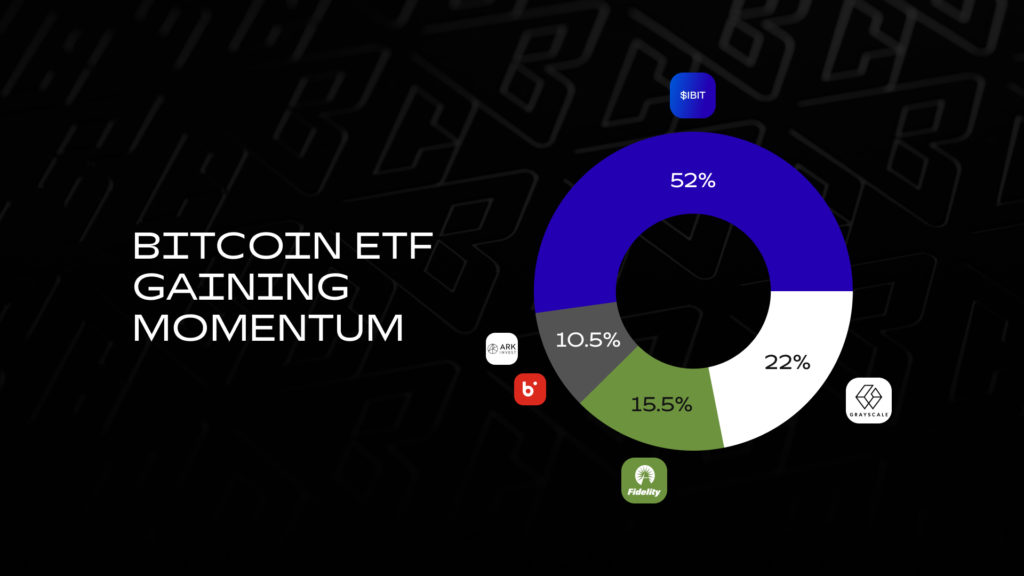

Bitcoin ETF Gaining Momentum

The inflow dynamics of BTC ETFs, approved by the SEC in the U.S. on January 11 from 11 major issuers, are the fastest in ETF history. Strong demand for BTC ETFs has led to a relentless rise in BTC from $40,000 to a new all-time high of $73,000. On March 12, a record inflow of $1.05 billion was recorded. Spot BTC ETFs now control 4.3% of the total BTC supply and hold the largest market share of BTC ETFs at 87%, with the remaining portion occupied by futures BTC ETFs, according to The Block.

As of April 9, 2024, the largest market share (52%) belongs to IBIT, BlackRock’s spot BTC ETF, which holds 264,300 BTC. Grayscale Bitcoin Trust ranks second with a market share of 22%, followed by Fidelity BTC ETF at 15.5%. ArkInvest BTC ETF, Bitwise BTC ETF, and six others account for 10.5%.

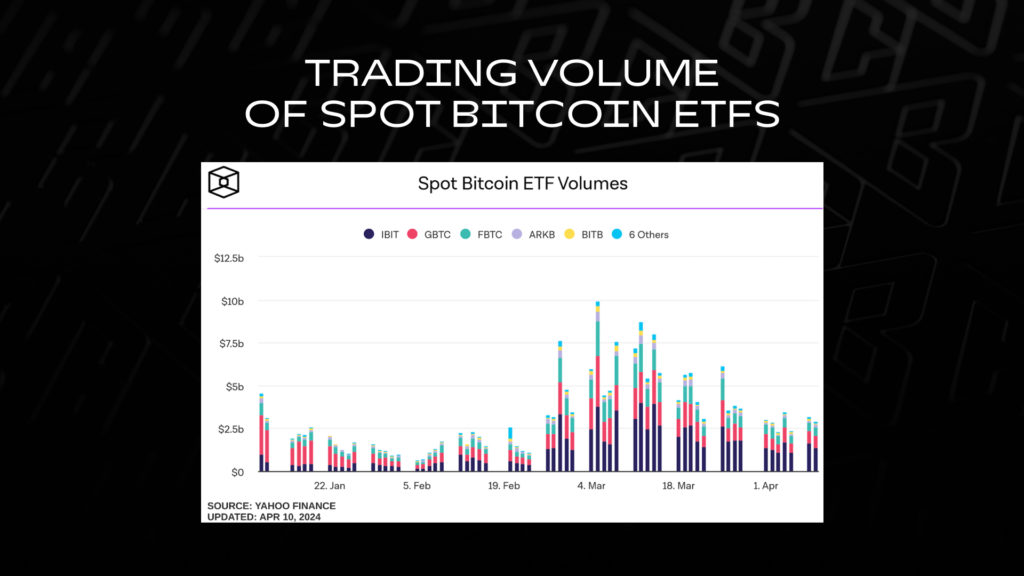

Trading Volume of Spot Bitcoin ETFs

The trading volume of spot BTC ETFs has decreased from a peak of $10 billion to $2.5-3 billion after BTC reached its all-time high.

Since daily inflows into BTC ETFs have a discrete structure and correlate with investor sentiment in the stock market, the stabilization of the U.S. stock market and a decline in U.S. government bond yields could lead to a new wave of BTC growth. This potential growth might coincide with a supply crisis from exchanges and miners.

Geographic Adoption of Bitcoin ETFs

As the BTC price rises, spot BTC ETFs are expected to be accepted in several other regions, including Europe, South Korea, Latin America, and more. In mid-April, the Hong Kong regulator approved the launch of spot ETFs based on BTC and ETH. The geographic expansion of spot BTC ETF acceptance will boost demand for BTC, increase trust in the industry among retail and institutional investors, and potentially trigger a new wave of growth.

Capital flows driven by spot BTC ETFs may represent the most fundamental shift in market structure, and the geographic expansion of these instruments will provide additional support to the market.

Bitcoin Halving and Supply Crisis

In April 2024, the Bitcoin halving took place – a process embedded in the BTC algorithm that reduces the block reward by half every four years. Currently, the block reward stands at 3.25 BTC.

Historically, BTC has surged after halvings as its supply decreases, attracting increasing investor attention. Despite reaching a new all-time high, BTC continues to be withdrawn from exchanges: when investors move BTC to cold wallets, it signals medium-term expectations of asset growth. BTC reserves on Coinbase have dropped to their lowest since 2017, which could further exacerbate the supply crisis following the halving.

Expectations for Market Dynamics in Q2-Q4 2024

According to Glassnode, comparing BTC’s price dynamics in the current cycle to the previous one suggests that BTC is in a phase similar to December 2020 in the 2017-2021 cycle, which is the third quarter of the cycle, typically preceding market euphoria.

The distribution of coins among long-term holders also indicates a late-stage cycle. According to Glassnode, this metric stands at 900,000 BTC, compared to the average distribution value of 1.5 million BTC before the peak of a bull cycle. As Bitcoin’s value rises, this process has accelerated.

The market is currently in a phase of greed and even hope, but euphoria is still some way off. It is likely to emerge as BTC approaches $100,000. This level remains the primary target for the price at the end of the current BTC bull cycle.

The End of the FTX Drama

The Southern District Court of New York sentenced Sam Bankman-Fried (SBF), former head of the cryptocurrency exchange FTX, to 25 years in prison. This is less than the initial request by prosecutor Damian Williams, who recommended a sentence of 40 to 50 years, citing Bankman-Fried’s refusal to acknowledge his role in what he called “possibly the biggest fraud of the last decade.”

FTX, the second-largest cryptocurrency exchange during the last bull market, included the exchange itself and the venture fund Alameda Research. A system backdoor allowed the company to transfer client funds to its venture division for investments in crypto startups and to take loans using its own token, FTT, as collateral. As the venture projects became unprofitable and the value of the FTT token dropped, especially after a significant sell-off by Binance’s founder triggered a decrease in FTT’s value, clients began to withdraw funds en masse from the exchange. Due to the lack of full coverage for client deposits because of unsuccessful investments, a significant shortfall in funds was discovered, leading to FTX’s bankruptcy.

What is DeFi?

Decentralized Finance (DeFi) is an entire economic ecosystem within blockchains operating in the digital world. The DeFi market volume currently stands at $95 billion, referring to the assets locked within protocols. This figure is halfway to its historical maximum and continues to gain momentum, with an almost 100% increase over the past year.

The DeFi market appears large and dense, although the total infrastructure volume is 3.7 times smaller than the top 10 American TD Bank, which holds $366 billion. With the entry of major institutional players into the cryptocurrency and DeFi markets, the Total Value Locked (TVL) metric is expected to rise.

Key applications of decentralized financial services include:

- Lending: DeFi allows borrowers and lenders to use cryptocurrencies or digital assets to obtain and provide loans.

- Decentralized Exchanges (DEX): DeFi enables the exchange of cryptocurrency and other digital assets without intermediaries.

- Insurance: DeFi offers the possibility of obtaining cryptocurrency insurance.

- Asset Management: DeFi allows for the management of digital assets and the ability to perform automated actions based on specific conditions.

What is DEX?

Decentralized exchanges (DEXs) are platforms for exchanging one cryptocurrency for another without involving any third-party organization, such as a trading platform or government body. DEXs operate autonomously using smart contracts. UniSwap still holds the largest market share in terms of trading volume and TVL, with PancakeSwap in second place.

The growth in trading volume indicates increasing interest from market participants in buying and selling assets. Over the past year, this figure has nearly doubled, positively impacting the returns of liquidity providers.

In the past year, the volume of fees distributed among liquidity providers exceeded $800 million, with a local record for fees paid out set in March 2024.

Liquidity Provision Strategy in DeFi Protocols

At Banana Capital, we employ a liquidity provision strategy in DeFi protocols. Yield is generated through trading fees. The approach enables us to achieve maximum efficiency, especially in volatile markets.

In contrast to traditional methods, we utilize hedging to protect positions, ensuring stability and consistent profitability. As a result, we address the issue of the underlying asset’s devaluation placed in the liquidity pool.

Strategy Yield for Q1 2024

Additionally, we are developing several other strategies for various trading pairs. Currently, only the strategy involving ETH is actively being used. For more detailed information about the strategy, please contact our manager: https://t.me/Manager_Banana_Capital

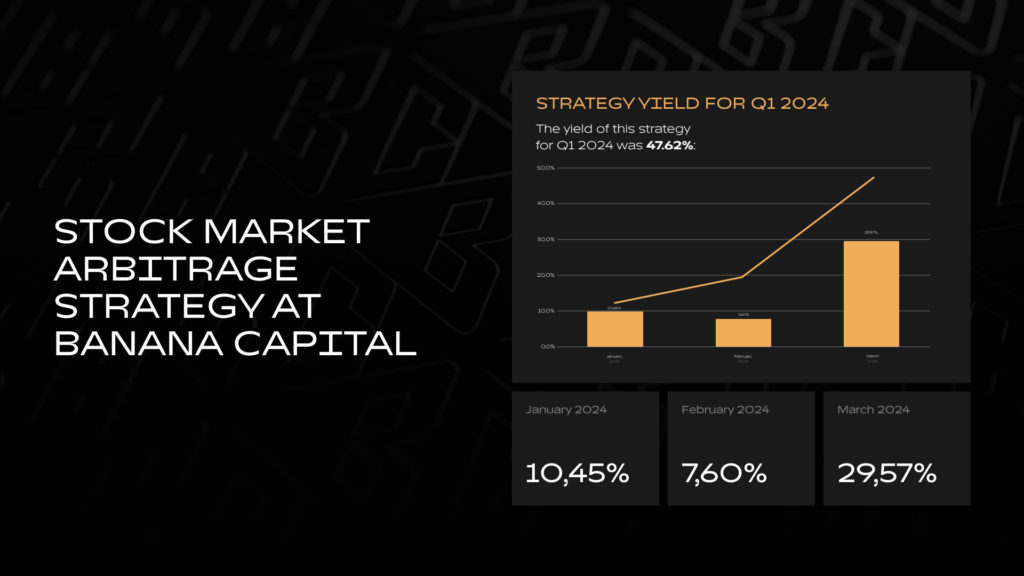

Stock Market Arbitrage Strategy

In this strategy, we exploit stock market inefficiencies. Yield is generated by reconciling assets trading at different prices across exchanges. Let’s illustrate with a simple example: coffee beans in Brazil may be sold for $1, while in Ecuador, they fetch $1.2. We buy beans in Brazil and sell them in Ecuador.

The advantage of this strategy lies in maintaining a neutral position independent of asset price fluctuations in the market. Essentially, we act as market makers, thereby eliminating these inefficiencies and bringing assets to a unified price.

Strategy Yield for Q1 2024

For more detailed information about the strategy, please contact our manager: https://t.me/Manager_Banana_Capital

ETH Staking and Liquid Staking

With ETH’s transition to a PoS system, where the network’s functionality is maintained by validators and stakers, more than a quarter of all Ethereum coins in circulation have been locked in various protocols.

Liquid Staking, Restaking, and Liquid Restaking have become trends in the new bull market and a real gold rush. In pursuit of high returns, people lock their tokens within protocols, thereby earning yields up to 5 times higher than the base while increasing their risks in the event of a protocol failure. The staking market is expanding rapidly, and with the collapse of one of the protocols, the house of cards could be shattered.

Retrodrop Trend in DeFi

Projects potentially offering airdrops:

- EigenLayer

- Superform

- Renzo

- Zircuit

- BLAST

We all remember DeFi Summer 2021, how projects emerged and generously rewarded their early users. History is repeating itself but on a different scale.

The staking trend is driving the development of new projects in this direction, and the launch of new projects involves token distribution (airdrop) for activity in protocols, for example: ether.fi, Ethena, and others.

Excessive market attention is devoted to DEX perps – decentralized derivatives or yet another trend of the new bull cycle. Over the past year, the market has seen numerous projects in this sector: Drift, Aevo, Hyperliquid, Kiloex, LogX, Zeta Market, Grvt, Zkex, and Thetanuts.

Largest Venture Deals Q1 2024

At the beginning of 2024, the financial landscape for early-stage startups showed significant changes. While the overall funding volume experienced a decline, activity at the early stage, including pre-seed and Series A deals, demonstrated a sharp increase. This shift in dynamics underscores growing investor interest in innovative companies at the early stages of development and confirms continued belief in the potential of the blockchain and cryptocurrency market.

- Ethena: Raised $14 million in a seed round managed by Dragonfly Capital. The project aims to maintain the stability of its synthetic dollar, USDe, relative to USD, offering a solution within the Ethereum ecosystem.

- Etherfi: Attracted attention with a $27 million Series A funding round led by Bullish and Coinfund. It focuses on enhancing staking and restaking capabilities in the Ethereum network through EigenLayer, aiming to maximize non-custodial staking.

- Eigen Labs: Secured a $100 million Series B round funded exclusively by a16z. Eigen Labs is behind the development of EigenLayer and EigenDA.

- Optimism: This Layer-2 scaling solution for Ethereum raised $89 million in a private round with undisclosed participants. Although the use of funds was not specified, the tokens are subject to a two-year lock-up, during which buyers can delegate tokens to “unaffiliated third parties for governance participation.”

- Zama: A cryptography company developing fully homomorphic encryption (FHE) for blockchain and artificial intelligence. It raised $73 million in a Series A round led by Multicoin and Protocol Labs. Unlike most existing data management methods, where data is encrypted during transmission but decrypted during processing, FHE allows data to remain encrypted during transmission and processing.

Pavel Durov Has Something Planned

TON Foundation to Launch Community Reward Initiative on April 1:

After successfully completing a pilot program to stimulate the ecosystem, which saw the TON token increase by 200% and key DEX platforms StonFi and Dedust grow by 620% and 339%, respectively, TON has announced the launch of a large-scale community reward program totaling $115 million, starting on April 1. This initiative aims to attract a significant number of new users to the TON ecosystem.

Rewards will be provided as follows:

- Developers: A prize pool of $15 million in Toncoin. This will be a general KPI competition for TON projects with an online leaderboard.

- Token Mining: Users can earn free tokens through mining mechanics. Projects can develop their viral mining mechanisms using TON and Telegram to earn additional rewards.

- Liquidity Pools: Top-tier projects will receive an additional 50,000 Toncoin, while smaller projects will receive 5,000 Toncoin.

Dencun Hard Fork in Ethereum

The activation of the Dencun hard fork in Ethereum has led to a significant reduction in gas fees in L2 networks that have implemented EIP-4844, thanks to the introduction of the Proto-Danksharding feature for scaling through a new type of transaction for large data arrays. This update, aimed at reducing fees for L2 solutions based on Rollups, has lowered the gas cost in Base from $0.7 to $0.0024, in Optimism from $0.66 to $0.0055, and zkSync from $0.32 to $0.097, as well as in other L2 networks by a significant factor.

Furthermore, since the beginning of the year, the altcoin market capitalization has demonstrated significant growth, which is attributed not only to the increase in the value of existing tokens in the market but also to the emergence of major projects such as Aevo, EtherFi, Polyhedra, and StarkNet.

This market activity of new projects is a positive signal for the industry, indicating high dynamics and growth opportunities. The launch of several major projects is expected in the first half of 2024, which could serve as an additional stimulus for the growth of the entire market.

Summing Up

The first quarter of 2024 has proven exceptionally successful for the cryptocurrency industry. It was marked by the approval of Bitcoin ETFs, leading to a significant influx of investments. Since the beginning of the year, the price of Bitcoin has surged by approximately 60%, and the overall market capitalization has doubled.

The release of major and long-awaited projects, including StarkNet, EtherFi, and Aevo, also played a key role in shaping positive market sentiment. These projects attracted investor attention and stimulated activity within the ecosystem.

Our expectations for the second half of the first semester are tied to the continued market growth following Bitcoin’s halving, as well as the potential superiority of the Ethereum ecosystem over Bitcoin and other projects. The reduction of fees across all L2 networks after the significant Dencun update is boosting activity, and the approval of an Ethereum ETF will encourage traders to focus their investments on this asset.

It is important to emphasize that institutional funds inflow into the cryptocurrency market occurs through ETFs and directly through integration with blockchains. Leading financial organizations, including BlackRock, utilize various blockchains for asset tokenization. Fidelity, for instance, plans to offer staking within its Ethereum ETF. These steps contribute to further developing the entire DeFi sector, which is a key component of the crypto ecosystem.

If you’d like to show appreciation for our work, please share the report with your friends and follow us on our social media channels. If you’re interested in our products, you can contact the fund manager here: https://t.me/Manager_Banana_Capital

Introducing Banana Crypto

The story of Banana Crypto began in 2017, and since then, we have grown into a team of 70 employees and developed an extensive ecosystem. We have expanded our product portfolio through several business directions, including:

- Banana Crypto: Международная компания, работающая в 14 криптовалютных секторах и имеющая 7 направлений бизнеса.

- Banana Capital: A full-cycle investment company: hedge fund, venture capital arm, and incubator, specializing in Web3 projects.

- Banana Labs: Венчурная инвестиционная платформа, которая связывает инвесторов с перспективными криптовалютными проектами на ранних стадиях.

- Banana Nodes: Подразделение, которое оказывает ряд услуг по стратегическому подходу к пассивному венчурному инвестированию в криптовалютные проекты ранних стадий.

- Banana Alliance: Сообщество энтузиастов, занимающееся различными активностями для получения дохода на криптовалютном рынке.

- Banana Media: Новостная экосистема, предоставляющая актуальную информацию и свежие тренды на криптовалютном рынке.

- Banana University: Криптовалютная образовательная платформа, предназначенная для людей с разным уровнем знаний.

- Banana Assistance: Подразделение, занимающееся предоставлением финансового сопровождения клиентов и консультационных услуг.

What is Banana Capital?

A full-cycle investment company: hedge fund, venture capital arm, and incubator specializing in Web3 projects.

Banana Capital’s history began in 2017 within a family office, where we actively invested our own capital. Over time, our strategies have demonstrated stability and high profitability in any market conditions.

Despite our emphasis on risk control and asset allocation, our investment returns surpass the US Venture Capital Index and CCI30. Even in conditions of high volatility and cyclicality in the Web3 market, our strategies enable capital growth yearly, regardless of market cycles.

Goal and Mission

- For Investors: Мы стремимся помочь инвесторам безопасно управлять капиталом, диверсифицируя риски, и стабильно получать высокий доход независимо от динамики криптовалютного рынка.

- For Founders: Мы оказываем поддержку основателям проектов не только в виде финансовых средств, но и предлагаем помощь в инкубации на ранних стадиях.

- Our Team: Используя многолетний опыт, мы служим для инвесторов воротами к возможностям для безопасного расширения капитала.

- Our Mission: Мы стремимся внести вклад в развитие криптовалютного рынка, используя безопасные и в то же время высокодоходные инвестиционные стратегии.

Our Advantages

- We offer portfolio creation and management services tailored to your needs, risk profile, capital volume, and investment horizon.

- We offer investors the opportunity to earn money in the cryptocurrency market using the same strategies we employ to grow our own capital.

- Since 2017, our strategies have demonstrated stability under any market conditions, outperforming the US Venture Capital Index and CCI30 in terms of investment returns.

- We are confident in the effectiveness of our strategies, so the majority of our commission structure is based on success fees. Our primary principle is simple: «We earn when the investor earns.»

- In the venture capital sphere, we don’t limit ourselves to investment; we also act as incubators, enhancing the value of projects and stimulating their growth.

Наша Команда

In the financial realm, each company serves as a place where not only money converges but also individuals’ deep knowledge, experience, and professionalism. While predicting trends and making informed decisions are crucial in financial markets, teamwork plays a significant role.

Banana Crypto boasts a team of over 70 individuals, each contributing to the company’s overall success and prosperity.

Contact Information

к нам?

к нам?